Longevity Risk – Will You Outlive Your Retirement Savings?

Longevity Risk is one of the biggest risks facing retirees – it is the risk of outliving your savings…

Longevity risk is a function of two unknowns –

1. how long you live, and

2. how your investments perform.

Continuing advances in healthcare and social change are seeing life expectancy increase.

One of the best ways to help manage longevity risk is to start saving for retirement as early as possible. This will maximise the monies available to you once you retire. Of course there will always be other demands on your finances, but a few extra dollars saved into super on a regular basis from the moment you start working will make an enormous difference (and create a disciplined savings approach from the outset).

In retirement there are products and ways of setting up your financial affairs to help minimise longevity risk and give yourself peace of mind as you age. A financial adviser can help you structure and invest your assets taking into consideration your financial position, goals and objectives for your retirement years, your health and other matters. And, for the time being, the age pension is a safety net for some retirees.

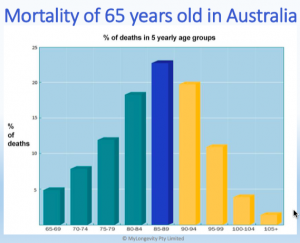

The chart below from MyLongevity shows the mortality of a 65 year old in Australia today. The majority of 65 year olds today will live to between 80 and 94 years old age.

Have you saved enough in superannuation and other assets to meet your ongoing living expenses for 15 to 30 years in retirement?