The iPhone Celebrates It’s 10th Anniversary

In 2007 Apple introduced the iPhone to the world and it revolutionised the way we communicate. Apple has continued to innovate and introduce new versions of the iPhone and other products over the last decade and currently is one of the largest companies in the world. Will Apple still be producing the number one smartphone in 2027?

Overnight Apple announced the release of three new iPhones – the iPhone8, iPhone8 Plus and iPhone X. The iPhone8 is similar to the iPhone7 with upgraded internal technology, however the iPhoneX has OLED screen technology, wireless charging and new features such as facial recognition.

The smartphone market is now saturated with real alternatives to the iPhone, and Apple is no longer the same innovative force it once was. Will the iPhone X be the solution or will Apple be overtaken in the telecommunications race? Is the iOS ecosystem Apple has built sufficient to keep loyal consumers onside? Apple needs to continue to lead through innovation, not just the iPhone, but other integrated software and hardware products.

What happened to old market leaders Nokia and Kodak?

Think back to the 1980s when the old brick phones became smaller and smaller… Nokia was the market leader and the company was known for releasing smaller, more practical mobile phones. However, sadly Nokia failed to see the importance of internet enabled smartphones and is no longer the iconic company it once was…

And, anyone born before 1986 knew Kodak as a household name. This was when Kodak was at the peak of it’s powers. A little known fact is that a Kodak engineer invented the first digital camera in 1975, and in the 1990s Kodak poured billions of dollars into developing technology for taking pictures using mobile phones and other digital devices. However, management made an ill-fated decision to hold back from developing digital cameras for the mass market for fear of killing off the company’s highly successful film business…. Where is Kodak now?

The ever-changing list of Fortune Global 500 Companies

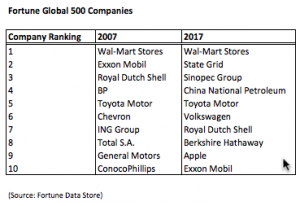

The world is evolving across all industries as can be seen in the Fortune Global 500 Top 10 Company listing for 2007 and 2017:

In 2007 the big oil companies dominated the top ten list of global companies, and financial services dominated the top 25

In 2017 the big oil companies have fallen down the list or disappeared altogether, Apple is number nine and three Chinese companies have joined the list.

Interestingly retailer Walmart was number one in both 2007 and 2017, and has claimed the top spot twelve times since 1995. ExxonMobil, Royal Dutch Shell and Toyota Motor Corporation are the only other companies to appear on both top ten lists.

What does this mean for investors?

What does all of the above mean for you, the investor? This shows the importance of diversification when investing.

The world is a constantly changing place. We are continually seeing new innovations across and within industries and sectors. Some of these are fast moving and others take time to be implemented and integrated into the mainstream.

Following the current ‘trend’ may reap rewards in the short term, but rarely does this pay-off in the longer term. Some active fund managers are able to pick the trends and invest ahead of the game. This may secure them a top quartile position in the performance rankings for a year or two, but inevitably they fall off their perch when the next trend comes along.

Some innovations are more than trends, and change the way we function forever. Forward looking companies will adapt and evolve to incorporate these changes. One company that comes to mind is Volkswagen, the world’s biggest carmaker, which has listened to consumer demand for clean vehicles and has pledged to move away from petrol and diesel and offer an electric version of all car models by the year 2030.

The importance of diversification

Investing based on forecasts about individual companies is extremely difficult as you need to take into consideration so many moving parts and future events.

A better approach is to diversify as broadly as possible across stocks, sectors and countries in order to lessen the influence of any one company, sector or jurisdiction.